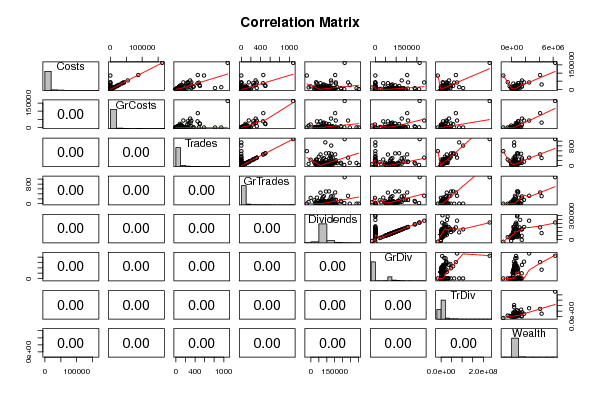

| Correlations for all pairs of data series (method=pearson) | ||||||||

| Costs | GrCosts | Trades | GrTrades | Dividends | GrDiv | TrDiv | Wealth | |

| Costs | 1 | 0.861 | 0.764 | 0.753 | 0.317 | 0.348 | 0.758 | 0.702 |

| GrCosts | 0.861 | 1 | 0.613 | 0.888 | 0.316 | 0.473 | 0.762 | 0.857 |

| Trades | 0.764 | 0.613 | 1 | 0.68 | 0.347 | 0.297 | 0.866 | 0.516 |

| GrTrades | 0.753 | 0.888 | 0.68 | 1 | 0.337 | 0.573 | 0.754 | 0.756 |

| Dividends | 0.317 | 0.316 | 0.347 | 0.337 | 1 | 0.437 | 0.539 | 0.442 |

| GrDiv | 0.348 | 0.473 | 0.297 | 0.573 | 0.437 | 1 | 0.385 | 0.406 |

| TrDiv | 0.758 | 0.762 | 0.866 | 0.754 | 0.539 | 0.385 | 1 | 0.723 |

| Wealth | 0.702 | 0.857 | 0.516 | 0.756 | 0.442 | 0.406 | 0.723 | 1 |

| Correlations for all pairs of data series with p-values | |||

| pair | Pearson r | Spearman rho | Kendall tau |

| Costs;GrCosts | 0.8606 | 0.4917 | 0.4377 |

| p-value | (0) | (0) | (0) |

| Costs;Trades | 0.7644 | 0.9357 | 0.8021 |

| p-value | (0) | (0) | (0) |

| Costs;GrTrades | 0.7526 | 0.4854 | 0.4108 |

| p-value | (0) | (0) | (0) |

| Costs;Dividends | 0.3169 | 0.428 | 0.3504 |

| p-value | (0) | (0) | (0) |

| Costs;GrDiv | 0.3476 | 0.2208 | 0.1753 |

| p-value | (0) | (0) | (0) |

| Costs;TrDiv | 0.7583 | 0.8971 | 0.7701 |

| p-value | (0) | (0) | (0) |

| Costs;Wealth | 0.7019 | 0.3269 | 0.2405 |

| p-value | (0) | (0) | (0) |

| GrCosts;Trades | 0.6132 | 0.4501 | 0.3825 |

| p-value | (0) | (0) | (0) |

| GrCosts;GrTrades | 0.8881 | 0.9964 | 0.9571 |

| p-value | (0) | (0) | (0) |

| GrCosts;Dividends | 0.3156 | 0.3101 | 0.2584 |

| p-value | (0) | (0) | (0) |

| GrCosts;GrDiv | 0.4726 | 0.7962 | 0.7344 |

| p-value | (0) | (0) | (0) |

| GrCosts;TrDiv | 0.7625 | 0.4279 | 0.3631 |

| p-value | (0) | (0) | (0) |

| GrCosts;Wealth | 0.8571 | 0.2496 | 0.2051 |

| p-value | (0) | (0) | (0) |

| Trades;GrTrades | 0.6798 | 0.4575 | 0.4094 |

| p-value | (0) | (0) | (0) |

| Trades;Dividends | 0.3472 | 0.4191 | 0.3349 |

| p-value | (0) | (0) | (0) |

| Trades;GrDiv | 0.2975 | 0.192 | 0.1557 |

| p-value | (0) | (1e-04) | (1e-04) |

| Trades;TrDiv | 0.8663 | 0.9562 | 0.918 |

| p-value | (0) | (0) | (0) |

| Trades;Wealth | 0.5159 | 0.3575 | 0.2586 |

| p-value | (0) | (0) | (0) |

| GrTrades;Dividends | 0.3368 | 0.311 | 0.2626 |

| p-value | (0) | (0) | (0) |

| GrTrades;GrDiv | 0.5734 | 0.7986 | 0.7402 |

| p-value | (0) | (0) | (0) |

| GrTrades;TrDiv | 0.7544 | 0.4354 | 0.3811 |

| p-value | (0) | (0) | (0) |

| GrTrades;Wealth | 0.756 | 0.2554 | 0.2077 |

| p-value | (0) | (0) | (0) |

| Dividends;GrDiv | 0.437 | 0.2956 | 0.2645 |

| p-value | (0) | (0) | (0) |

| Dividends;TrDiv | 0.5385 | 0.5341 | 0.4188 |

| p-value | (0) | (0) | (0) |

| Dividends;Wealth | 0.4423 | 0.4309 | 0.3396 |

| p-value | (0) | (0) | (0) |

| GrDiv;TrDiv | 0.3846 | 0.2432 | 0.1986 |

| p-value | (0) | (0) | (0) |

| GrDiv;Wealth | 0.406 | 0.1991 | 0.1564 |

| p-value | (0) | (0) | (0) |

| TrDiv;Wealth | 0.7229 | 0.4011 | 0.2881 |

| p-value | (0) | (0) | (0) |