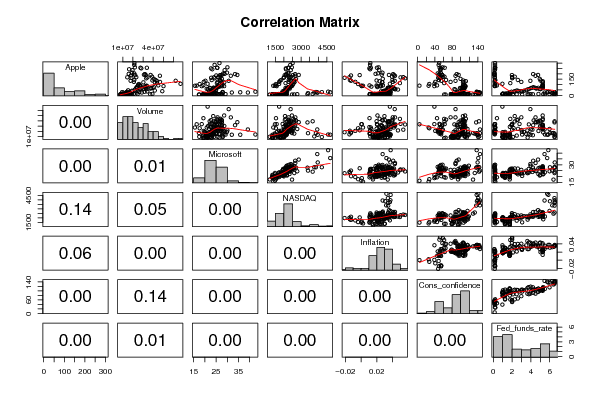

| Correlations for all pairs of data series with p-values |

| pair | Pearson r | Spearman rho | Kendall tau |

| Apple;Volume | 0.4177 | 0.657 | 0.4509 |

| p-value | (0) | (0) | (0) |

| Apple;Microsoft | 0.3235 | 0.4806 | 0.3489 |

| p-value | (2e-04) | (0) | (0) |

| Apple;NASDAQ | 0.129 | 0.4773 | 0.3665 |

| p-value | (0.1436) | (0) | (0) |

| Apple;Inflation | -0.163 | 0.0099 | 0.0283 |

| p-value | (0.0638) | (0.9113) | (0.6334) |

| Apple;Cons_confidence | -0.5898 | -0.4087 | -0.2318 |

| p-value | (0) | (0) | (1e-04) |

| Apple;Fed_funds_rate | -0.2913 | -0.1938 | -0.1041 |

| p-value | (8e-04) | (0.0272) | (0.0806) |

| Volume;Microsoft | 0.215 | 0.3204 | 0.22 |

| p-value | (0.014) | (2e-04) | (2e-04) |

| Volume;NASDAQ | 0.171 | 0.4616 | 0.3269 |

| p-value | (0.0517) | (0) | (0) |

| Volume;Inflation | 0.2967 | 0.3365 | 0.2191 |

| p-value | (6e-04) | (1e-04) | (2e-04) |

| Volume;Cons_confidence | -0.13 | -0.0633 | -0.0344 |

| p-value | (0.1404) | (0.4745) | (0.5622) |

| Volume;Fed_funds_rate | 0.2256 | 0.2268 | 0.1344 |

| p-value | (0.0099) | (0.0095) | (0.0241) |

| Microsoft;NASDAQ | 0.768 | 0.8016 | 0.6273 |

| p-value | (0) | (0) | (0) |

| Microsoft;Inflation | 0.3221 | 0.3425 | 0.2363 |

| p-value | (2e-04) | (1e-04) | (1e-04) |

| Microsoft;Cons_confidence | 0.3349 | 0.2753 | 0.2045 |

| p-value | (1e-04) | (0.0015) | (6e-04) |

| Microsoft;Fed_funds_rate | 0.4382 | 0.4049 | 0.3006 |

| p-value | (0) | (0) | (0) |

| NASDAQ;Inflation | 0.3601 | 0.494 | 0.3282 |

| p-value | (0) | (0) | (0) |

| NASDAQ;Cons_confidence | 0.5349 | 0.4205 | 0.3008 |

| p-value | (0) | (0) | (0) |

| NASDAQ;Fed_funds_rate | 0.6486 | 0.6095 | 0.4338 |

| p-value | (0) | (0) | (0) |

| Inflation;Cons_confidence | 0.4361 | 0.3664 | 0.2466 |

| p-value | (0) | (0) | (0) |

| Inflation;Fed_funds_rate | 0.548 | 0.6108 | 0.4216 |

| p-value | (0) | (0) | (0) |

| Cons_confidence;Fed_funds_rate | 0.8133 | 0.8401 | 0.6546 |

| p-value | (0) | (0) | (0) |