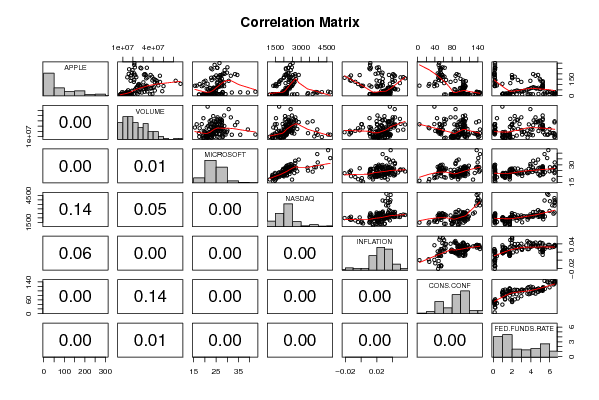

| Correlations for all pairs of data series (method=pearson) | |||||||

| APPLE | VOLUME | MICROSOFT | NASDAQ | INFLATION | CONS.CONF | FED.FUNDS.RATE | |

| APPLE | 1 | 0.418 | 0.323 | 0.129 | -0.163 | -0.59 | -0.291 |

| VOLUME | 0.418 | 1 | 0.215 | 0.171 | 0.297 | -0.13 | 0.226 |

| MICROSOFT | 0.323 | 0.215 | 1 | 0.768 | 0.322 | 0.335 | 0.438 |

| NASDAQ | 0.129 | 0.171 | 0.768 | 1 | 0.36 | 0.535 | 0.649 |

| INFLATION | -0.163 | 0.297 | 0.322 | 0.36 | 1 | 0.436 | 0.548 |

| CONS.CONF | -0.59 | -0.13 | 0.335 | 0.535 | 0.436 | 1 | 0.813 |

| FED.FUNDS.RATE | -0.291 | 0.226 | 0.438 | 0.649 | 0.548 | 0.813 | 1 |

| Correlations for all pairs of data series with p-values | |||

| pair | Pearson r | Spearman rho | Kendall tau |

| APPLE;VOLUME | 0.4177 | 0.657 | 0.4509 |

| p-value | (0) | (0) | (0) |

| APPLE;MICROSOFT | 0.3235 | 0.4806 | 0.3489 |

| p-value | (2e-04) | (0) | (0) |

| APPLE;NASDAQ | 0.129 | 0.4773 | 0.3665 |

| p-value | (0.1436) | (0) | (0) |

| APPLE;INFLATION | -0.163 | 0.0099 | 0.0283 |

| p-value | (0.0638) | (0.9113) | (0.6334) |

| APPLE;CONS.CONF | -0.5898 | -0.4087 | -0.2318 |

| p-value | (0) | (0) | (1e-04) |

| APPLE;FED.FUNDS.RATE | -0.2913 | -0.1938 | -0.1041 |

| p-value | (8e-04) | (0.0272) | (0.0806) |

| VOLUME;MICROSOFT | 0.215 | 0.3204 | 0.22 |

| p-value | (0.014) | (2e-04) | (2e-04) |

| VOLUME;NASDAQ | 0.171 | 0.4616 | 0.3269 |

| p-value | (0.0517) | (0) | (0) |

| VOLUME;INFLATION | 0.2967 | 0.3365 | 0.2191 |

| p-value | (6e-04) | (1e-04) | (2e-04) |

| VOLUME;CONS.CONF | -0.13 | -0.0633 | -0.0344 |

| p-value | (0.1404) | (0.4745) | (0.5622) |

| VOLUME;FED.FUNDS.RATE | 0.2256 | 0.2268 | 0.1344 |

| p-value | (0.0099) | (0.0095) | (0.0241) |

| MICROSOFT;NASDAQ | 0.768 | 0.8016 | 0.6273 |

| p-value | (0) | (0) | (0) |

| MICROSOFT;INFLATION | 0.3221 | 0.3425 | 0.2363 |

| p-value | (2e-04) | (1e-04) | (1e-04) |

| MICROSOFT;CONS.CONF | 0.3349 | 0.2753 | 0.2045 |

| p-value | (1e-04) | (0.0015) | (6e-04) |

| MICROSOFT;FED.FUNDS.RATE | 0.4382 | 0.4049 | 0.3006 |

| p-value | (0) | (0) | (0) |

| NASDAQ;INFLATION | 0.3601 | 0.494 | 0.3282 |

| p-value | (0) | (0) | (0) |

| NASDAQ;CONS.CONF | 0.5349 | 0.4205 | 0.3008 |

| p-value | (0) | (0) | (0) |

| NASDAQ;FED.FUNDS.RATE | 0.6486 | 0.6095 | 0.4338 |

| p-value | (0) | (0) | (0) |

| INFLATION;CONS.CONF | 0.4361 | 0.3664 | 0.2466 |

| p-value | (0) | (0) | (0) |

| INFLATION;FED.FUNDS.RATE | 0.548 | 0.6108 | 0.4216 |

| p-value | (0) | (0) | (0) |

| CONS.CONF;FED.FUNDS.RATE | 0.8133 | 0.8401 | 0.6546 |

| p-value | (0) | (0) | (0) |